Travel With Us

"Life is either a daring adventure or nothing at all."

About

A fast look at a Kelley Blue Book will tell you whether you need gap insurance coverage. Is your automobile currently worth less than the balance on the loan? If so, you need gap insurance coverage. You can include space insurance coverage to your regular comprehensive automobile insurance plan for just $20 a year, according to the Insurance Market Institute. That stated, your cost will differ according to the usual laws of insurance. That is, your state, age, driving record, and the real model of the lorry all play a part in prices. A major insurer will usually price it at 5% to 6% of the collision and thorough premiums on your vehicle insurance coverage policy.

Going to an insurance company for gap coverage is typically more affordable than the two other choices, going through the dealer or a loan provider, according to Bank Rate Screen. There's a great chance the vehicle dealer will try to offer you space coverage before you repel the lot. In truth, some are needed by state law to offer it. But dealerships generally charge significantly more than the major insurance coverage companies. Usually, a car dealership will charge you a flat rate of $500 to $700 for a space policy. So, it pays to look around a bit, starting with your present car insurer.

Another benefit of opting for a big-name carrier is that it's easy to drop the space protection once it no longer makes financial sense. Here are some quick responses to the most commonly-asked concerns about space insurance. If there is any time during which you owe more on your automobile than it is currently worth, space insurance coverage is certainly worth the money. If you put down less than 20% on a car, you're sensible to get gap insurance coverage at least for the very first number of years you own it. By then, you ought to owe less on the vehicle than it deserves.

Gap insurance coverage is especially worth it if you make the most of a dealer's periodic car-buying reward. If you're getting a deal for a low down payment and three months "totally free," you are certainly going to be upside-down on that loan for numerous months to come. Extensive automobile insurance is full coverage. It consists of crash insurance however likewise covers every unexpected calamity that can destroy an automobile, from vandalism to a flood. But it pays the actual cash value of the automobile, not the price you paid for it or the amount you might still owe on the loan. Gap insurance coverage covers the distinction.

The 30-Second Trick For What Is A Deductible Health Insurance

That is more than likely to happen in the very first couple of years of ownership, while your brand-new automobile is diminishing quicker than your loan balance is diminishing. You can cancel the space insurance coverage when your loan balance is low enough to be covered completely by a crash insurance payment. Believe of it as an additional insurance plan for your auto loan. If your vehicle is damaged, and your extensive car insurance coverage pays less than you owe the lender, the space policy will comprise the distinction. The easiest method, and most likely the cheapest method, is to ask your car insurance provider if they can add it to your existing policy.

The vehicle dealership will probably provide you a space policy however the rate will nearly definitely be greater than a major insurer will provide. In any case, check to make sure you do not already have gap insurance on your vehicle. Car lease deals often build space coverage into their pricing. Yes. Your best choice is to call your automobile insurance provider and ask whether you can include it to your existing policy. Did you know that there are actually $16 kinds of auto insurance coverage and another five optional insurance coverage items for motorists? And, as if that weren't made complex enough, the requirements for coverage and the cost of the products vary by state.

Nevertheless, it's a product that could give you significant assurance if you recently spent for a brand-new vehicle. Expect you purchased a $30,000 cars and truck and, two years later, it's stolen and never ever recuperated. Due to depreciation, the cars and truck is now worth just $21,000 on the marketplace. You still owe the loan provider $24,000. If you have gap coverage, the insurance carrier will begin $3,000 to cover the difference. If you do not, you owe the lending institution $3,000 expense. Gap insurance coverage is practical for those with significant negative equity in a car. That consists of drivers who put little money down or have a lengthy loan benefit period.

Many or all of the products featured here are from our partners who compensate us. What is an insurance premium. This may affect which products we blog about and where and how the product appears on a page. However, this does not affect our evaluations. Our viewpoints are our own. The minute you drive off the lot, a brand-new lorry loses some worth around 20% to 30% total in the very first year. After that, the vehicle's worth will continue to decline. If your car is amounted to or stolen, standard automobile insurance coverage will only spend for the value of the automobile at the time of the occurrence.

Examine This Report about How Much Is Renters Insurance

This is where gap insurance can come in convenient. Gap insurance coverage pays for the difference in between the value of a car at the time it's amounted to or stolen and the balance of its loan or lease. Though it may appear to describe that difference, "space" actually represents "surefire property defense." Normally, you'll need to buy crash and thorough protection in order to purchase space insurance coverage. Space insurance supplements the payout you obtain from thorough or collision coverage if your automobile is amounted to or stolen. Some space insurance plans http://ricardoafyy038.raidersfanteamshop.com/see-this-report-about-how-to-find-a-life-insurance-policy-exists likewise cover your insurance deductible. That's the amount deducted from the payment for a timeshare mortgages thorough or collision claim.

When you owe more on your car loan Go to this site or lease than that, gap insurance comes to the rescue. For example, let's say you rent or buy a new car with a vehicle loan and your vehicle is totaled in the very first year. Your collision insurance pays $15,000, the worth of the car at the time, minus the deductible. If you still owed $20,000 on your loan, gap insurance coverage would pay the remaining $5,000. You'll usually need to purchase gap insurance coverage within three years of purchasing a brand-new car at a minimum. Although insurance providers guidelines differ, a company may need one or both of the following: Your automobile disappears than 2 to three years old.

Once your automobile is no longer new, gap coverage usually expires. Some companies might need you to call and eliminate it. There are three main methods to buy gap insurance: From your automobile insurance provider, as part of your regular insurance coverage payment. From a company that sells gap insurance coverage just for a one-time fee. Through the dealership or loan provider, rolled into your loan payments. With this arrangement, you're paying interest on the expense of your gap insurance coverage over the life of the loan. A few of the biggest insurance coverage companies that provide stand-alone gap insurance coverage as add-ons to automobile insurance coverage are: American Household.

What Does How Much Does A Doctor Visit Cost Without Insurance Mean?

Term life insurance coverage provides coverage for a certain time duration. It's typically called "pure life insurance coverage" since it's designed only to protect your dependents in case you die too soon. If you have a term policy and die within the term, your recipients receive the payout. The policy has no other worth (how many americans don't have health insurance).

Typical terms are 10, 20 and 30 years. With most policies, the payout called the death advantage and the expense, or premium, stay the https://sethwivc893.mystrikingly.com/blog/the-greatest-guide-to-how-to-find-a-life-insurance-policy-exists same throughout the term. When you purchase term life: Pick a term that covers the years you'll be paying the costs and desire life insurance coverage in case you die.

The payment could change your earnings and help your family pay for services you carry out now, such as childcare. Preferably, your requirement for life insurance coverage will end around the time the term life policy expires: Your kids will be on their own, you'll have paid off your home and you'll have lots of money in cost savings to serve as a financial safeguard.

Entire life insurance coverage offers long-lasting coverage and includes a financial investment component referred to as the policy's money worth. The money value grows slowly in a tax-deferred account, meaning you will not pay taxes on its gains while they're building up. You can obtain cash against the account or surrender the policy for money.

Although it's more complex than term life insurance, whole life is the most simple form of permanent life insurance. Here's why: The premium remains the very same for as long as you live. The death advantage is ensured. The money worth account grows at a guaranteed rate. Some whole life policies can likewise make yearly dividends, which pay you back with a bit of the insurer's revenue.

Dividends are not guaranteed. Term life insurance coverage is cheap due to the fact that it's momentary and has no cash worth; in the majority of cases, your family won't receive a payment since you'll live to the end of the term. Entire life insurance coverage premiums are much greater due to the fact that the coverage lasts for a lifetime, and the policy has money value, with an ensured rate of financial investment return on a part of the cash that you pay.

We used 20-year and 30-year term life policies because no apples-to-apples contrast is possible for the length of term life to whole life. Term life is adequate for most households who require life insurance, but entire life and other kinds of permanent protection can be helpful in particular situations. Just require life insurance coverage to replace your earnings over a particular duration, such as the years you're raising kids or settling your home mortgage.

Facts About How Much Does A Filling Cost Without Insurance Revealed

Believe you may desire long-term life insurance however can't manage it. The majority of term life policies are convertible to permanent coverage. The deadline for conversion differs by policy. Believe you can invest your cash much better. Buying a more affordable term life policy lets you invest what you would have paid for a whole life policy.

In 2020, estates worth more than $11. 58 million per individual or $23. 16 million per couple undergo federal estate taxes - how much do dentures cost without insurance. State inheritance and estate taxes differ. Have a long-lasting dependent, such as a child with unique needs. Life insurance coverage can money a special needs trust to offer look after your kid after you're gone.

Desire to spend your retirement cost savings and still leave an inheritance or money for final expenses, such as funeral costs. Desire to equalize inheritances. If you prepare to leave a company or home to one child, entire life insurance might compensate your other children. If you require long-lasting protection however want more investing alternatives in your life insurance coverage than whole life offers, consider other kinds of irreversible life insurance.

Variable life insurance coverage or variable universal life insurance both offer you access to direct financial investment in the stock market. Indexed universal life insurance coverage pays interest based on the motion of stock indexes. In addition to the financial investments they use, all these options can likewise be cheaper than entire life if the marketplace works together.

That can result in excellent savings or to unforeseen expenses. As always, discussing your specific requirements with a fee-only financial coordinator is a fantastic primary step.

If you're like over half of Americans in these extraordinary times, you're most likely thinking of purchasing life insurance. At the start of 2020, of the Americans who didn't own life insurance, 36% meant to buy it. In May, after the COVID-19 pandemic break out started, that number jumped to 53%.

Here's more on what whole life insurance is, to assist you decide if entire life insurance coverage is a great choice for you, and how it works. When buying insurance due to COVID-19 issues, ensure that your policy doesn't have a restricted payout in the first two years, which may lower what you plan to leave to your family.

How Much Does Mortgage Insurance Cost Things To Know Before You Buy

This differs from like term life, which just pays a death benefit if you die within a limited period, say 5 or 10 years. Payments you make towards your whole life policy ought to stay constant throughout your life, which might make budgeting simpler. You spend for your survivor benefit while likewise constructing a money reserve or "cost savings account" of sorts.

You may likewise hear whole life insurance referred to as "cash worth life insurance coverage." Pros Dependable premium payments Lifelong coverage Guaranteed advantage at death Tax advantages Dividends might be readily available with some insurer and plans Cons Guaranteed cash worth might not be as competitive as investing Limitations on accessing cash value More pricey than term insurance Complex plan options, which can be complicated You'll make an application for insurance, which might need a medical examination, your medical history and your moms and dads' case history, financial details, and other details.

In all, the application and approval procedure may take about four to six weeks. The insurance provider then sets the premium (price you'll pay), which ought to be predictable throughout the agreement. It's based upon your age, health, and quantity of insurance at the time of more info purchaseit won't alter as you age or if your health decreases.

The hilton timeshare las vegas other part goes into the savings part known as the cash value of the policy. how to get dental implants covered by insurance. People buy entire life insurance coverage for different reasons, however the most common are to supplement retirement earnings, replace lost income for recipients after death, and to help spend for funeral expenses. Some life insurance coverage policies require "complete medical underwriting," which indicates you require to take a medical exam, consisting of having laboratory work done, and waitingperhaps for a month or morefor the results.

If you pass the questions, some life insurance coverage business will issue the policy without the requirement for a medical test. This is called streamlined problem or simplified underwriting. Streamlined concern makes it convenient and quick to make an application for insurance coverage. However if you're healthy, you can get a better rate by taking the medical examination and getting complete medical underwriting.

The 10-Second Trick For What Is Group Term Life Insurance

According to the 2020 long term care insurance coverage Price Index the expenses for LTC insurance can differ significantly. That's why we think it is so important to speak to an expert prior to you buy. Typical Expense - Single $1,700-per-year * Average Cost - Single $2,675-per-year * Typical Expense - Couple $3,050-COMBINED-- per-year * LOWEST - Single $1,876-per-year * LOWEST - Single $3,141-per-year * LOWEST - Couple $4,826-COMBINED-- per-year * HIGHEST - Single $3,081-per-year * HIGHEST - Single $5,085-per-year * HIGHEST - Couple $8,534-COMBINED-- per-year * * Age 55, basic health rate.

Protection worth will increase annually since a 3 percent compound inflation development alternative was included. ** Contrast of leading policies sold in 2020. Generally the leading 5 business available presently as of September 2020. Each insurance provider sets their own rate and we have discovered that each business has a.

The Association's yearly LTC insurance coverage Rate Index looks at the leading insurance coverage business consisting of the AARP long term care insurance strategy and we find that the business offering the very best rate for a 55-year-old couple DOES NOT use the finest rate for a 65-year-old couple. Ask the insurance representative or financial agent the following question:. A couple age 60 and 65, for example, would together pay about $1,500 a year for a three-year policy that provides a $1,500 monthly benefit with 3% substance inflation protection, Thau states. The $1,500 regular monthly benefit would cover 75 hours of house care a month. Frequently, Thau says, monetary advisers talk about just higher advantage levels that would cover the cost of assisted living or a nursing-home stay.

A policy that would cover many of the costs at a facility expenses substantially more. Genworth, for instance, currently charges a healthy 55-year-old married couple more than $6,700 a year for a three-year policy with a $150 daily advantage and 5% substance inflation security. And today, that policy would cover only 60% to 70% of nursing-home expenses-- the nationwide mean rate for a semi-private room is $220 a day, while a private space expenses $250 a day, according to Genworth.

However the $150 would cover simply 7. 5 hours a day for a home health assistant. To find the cost of home care, adult day health care, assisted-living centers and retirement home in your community, go to www. genworth.com/costofcare. As soon as you've considered the type of danger you want to cover, ask yourself, "how much of that risk can you move to the insurer, and how much can you tolerate on your own?" Burns states.

4 Easy Facts About Who Is Eligible For Usaa Insurance Explained

Lots of policies use a 90-day removal period, but prepare to spend $22,500 expense for nursing-home care http://elliottddgx715.theglensecret.com/how-much-is-domino-s-carryout-insurance-the-facts up until benefits start. The longer your elimination period, the lower your premium will be. what is a premium in insurance. A 90-day removal duration costs about 40% less than a zero-day deductible, says James Glickman, president of LifeCare Assurance, a long-term-care reinsurer in Woodland Hills, Cal.

An advantage period of 3 to 5 years "will cover the huge majority" of long-term-care requirements, says Dawn Helwig, a principal at actuarial and consulting firm Milliman. Customers "shouldn't seem like they have to buy the Cadillac policy," she says. Among the most reliable-- and questionable-- ways to decrease costs is to select a lower level of inflation security.

And an increasing variety of Genworth consumers are selecting even less expensive choices such as 2% or no inflation defense, says Chris Conklin, the company's senior vice-president for item style. Some monetary consultants fear that inflation protection of 3% or less won't stay up to date with increasing long-term-care expenses. But depending upon your budget and the type of danger you're attempting to cover, more limited inflation defense might make good sense.

Of course, inflation might get in the future when you need care. When comparing alternatives, think about the effect of different levels of inflation defense on the size of your advantage at the time you're likely to use care. A 60-year-old couple, for example, can together pay $2,170 a year what is my timeshare worth for a policy with a $150 everyday benefit, three-year advantage period, 90-day elimination period and no inflation security.

Or they can pay $3,930 a year for the very same policy with 3% yearly inflation security, and the worth of their advantage will grow to $325,000 per person at age 80, for example, and $365,000 per person at age 85, according to the American Association for Long-Term Care Insurance Coverage. Another technique: Select a policy with a "future purchase option," which has no automatic inflation change, lets you pay a lower premium today and offers you the choice of enhancing coverage down the road.

The Best Guide To Where Can I Go For Medical Care Without Insurance

" There's a lower cost entering, which enables some versatility to handle inflation gradually," states Kamilah Williams-Kemp, vice-president of long-lasting care at Northwestern Mutual. But Burns alerts that the future-purchase choice can be "a dangerous idea." When adding inflation modifications in future years, "you're paying more based on your age, and at some timeshare in hawaii time you price yourself out," she says.

Premiums will climb up with each year you age. The 60-year-old couple above, who would pay $3,930 for the policy with 3% inflation protection, will pay $6,177 if they wait up until 65 to purchase. Buying while still in excellent health has actually ended up being more crucial as insurers tighten underwriting requirements. Some business have included blood-test requirements and began inspecting household health history for conditions such as heart illness and dementia.

The majority of companies won't issue policies to people over 75, states Jesse Slome, the association's executive director. Married couples ought to think about a "shared care" rider, which permits couples to share advantages. If a husband and partner each have a three-year benefit duration, for instance, and the other half establishes dementia and consumes three years of care, she can dip into her husband's advantages.

Because women live longer than guys, insurance companies in the last few years have actually begun charging single females higher premiums than single men-- typically about 50% more. If possible, single ladies thinking about protection should acquire it through a company, since unisex rates is still offered in the employer market. You can keep the policy when you leave your job.

Less individuals have actually dropped these policies than anticipated, and insurers have dealt with more claims than anticipated. At the same time, a long period of ultra-low interest rates has left insurers with lower investment incomes than they predicted. Insurers are enabled to raise premiums even after you buy the policy, so consumers need to factor future premium increases into their budget plan.

Little Known Facts About How To Get A Breast Pump Through Insurance.

In the past, expense of mortgage insurance coverage included a down payment of 20% in order to secure a home loan (how to cancel state farm insurance). The objective was to ensure that the buyer would not default, since doing so would mean losing a substantial quantity of cash. The theory was that if the buyer defaulted, the loan provider would have the ability to recuperate at least that 20% by offering the home following foreclosure. When you re-finance into a conventional loan and keep at least 20% equity in your house, you won't be required to acquire mortgage insurance. If you wish to know more about MIP on your Quicken Loans home mortgage, you can talk to one of our House Loan Professionals.

Typically, customers making a deposit of less than 20 percent of the purchase rate of the home will require to pay for home loan insurance. Home loan insurance coverage likewise is typically needed on FHA and USDA loans. Mortgage insurance lowers the danger to the loan provider of making a loan to you, so you can get approved for a loan that you might not otherwise be able to get.

If you are required to pay mortgage timeshare pros and cons insurance, it will be consisted of in your overall regular monthly payment that you make to your lender, your costs at closing, or both. Warning: Home loan insurance coverage, no matter what kind, safeguards the lender not you in case you fall behind on your payments.

How How Much Is The Fine For Not Having Health Insurance can Save You Time, Stress, and Money.

There are a number of various sort of loans readily available to borrowers with low deposits. Depending on what kind of loan you get, you'll spend for home loan insurance in various methods: If you get a traditional loan, your lending institution may schedule home mortgage insurance with a private company. Private home mortgage insurance coverage (PMI) rates differ by deposit quantity and credit score but are typically more affordable than FHA rates for debtors with good credit.

Under specific circumstances, you can cancel your PMI.If you get a Federal Real Estate Administration (FHA) loan, your home loan insurance coverage premiums are paid to the Federal Housing Administration (FHA). FHA mortgage insurance coverage is required for all FHA loans. It costs the exact same no matter your credit report, with just a minor boost in rate for down payments less than 5 percent.

If you do not have adequate cash on hand to pay the upfront cost, you are allowed to roll the charge into your home loan rather of paying it expense. If you do this, your loan quantity and the overall expense of your loan will increase. If you get a US Department of Farming (USDA) loan, the program is similar to the Federal Housing Administration, but generally cheaper.

Unknown Facts About How Much Does It Cost To Fill A Cavity With Insurance

Like with FHA loans, you can roll the in advance portion of the insurance coverage premium into your mortgage rather of paying it out of pocket, but doing so increases both your loan amount and your overall expenses. If you get a Department of Veterans' Affairs (VA)- backed loan, the VA assurance changes home loan insurance, timeshare rentals and works likewise.

Nevertheless, you will pay an in advance "funding cost." The quantity of that fee varies based on: Your kind of military serviceYour down payment amountYour disability statusWhether you're purchasing a house or refinancingWhether this is your first VA loan, or you've had a VA loan before When you've settled a few of your loan, you might be qualified to cancel your mortgage insurance coverage.

Find out more about cancelling your home mortgage insurance coverage. Like with FHA and USDA loans, you can roll the upfront cost into your home loan instead of paying it expense, however doing so increases both your loan quantity and your total expenses. Warning: As an option to home loan insurance, some loan providers may provide what is referred to as a "piggyback" second home mortgage.

Some Known Details About How Does Term Life Insurance Work

Always compare the total cost prior to making a final choice. Find out more about piggyback 2nd home loans. If you're behind on your home mortgage, or having a difficult time paying, you can utilize the CFPB's " Discover a Therapist" tool to get a list of real estate therapy agencies in your location that are approved by HUD.

By clicking "See Rates", you'll be directed to our ultimate parent business, LendingTree. Based on your credit reliability, you may be matched with as much as five various lending institutions. The cost of private mortgage insurance coverage (PMI) is based upon the loan quantity, the customers' credit reliability and the portion of a house's value that would be paid for a claim.

Despite the worth of a house,. That indicates if $150,000 was borrowed and the annual premiums expense 1%, the debtor would need to pay $1,500 each year ($ 125 per month) to insurance their mortgage. Credit report do not just affect home mortgage and rates, they also affect PMIS. Here is an example of how elements such as credit reliability impact the expense of https://articlescad.com/the-best-guide-to-what-does-term-life-insurance-mean-708371.html home loan insurance: Think about two individuals who each want to buy a home valued $100,000 and can each put down $10,000 or 10% of the value of the house.

Which Of The Following Typically Have The Highest Auto Insurance Premiums? for Dummies

To reveal this, we graphed the cost difference across credit report silos for a home loan insurance coverage used by Radian. The policy is for a borrower-paid home loan insurance plan that covers a fixed rate loan with a term longer than twenty years. You can see that if Customer A has a FICO credit rating of 760 or greater and Debtor B has a rating lower than 639, Customer B's home loan insurance coverage premiums would cost 4x Borrower A's.

It may sound complex, however determining these aspects for a policy is easy. A lot of home mortgages must be guaranteed if they have a loan-to-value ratio (LTV ratio) of 80% to 97%. To put it simply, if a customer can just make a down payment between 20% and 3% of the value of a home, they will likely require a mortgage insurance plan.

In the table listed below of a home mortgage insurance coverage policy used by Genoworth Home mortgage Insurance Corporation, the distinction in between LTV ratio and the cost of the policy are clear. The rates are for borrower-paid yearly premiums for non set rate home loans and based upon LTV ratios, the coverages provided within each ratio, and the expense of the premiums for each PMI policy offered the danger swimming pool (the FICO rating of the debtor).

How Long Can A Child Stay On Parents Health Insurance Can Be Fun For Everyone

One of the very best ways to get a good rate on cars and truck insurance coverage is to enhance your driving habits. Safe chauffeurs have fewer mishaps. When a motorist decreases the frequency of accidents on their driving record, thus decreasing the variety of claims they submit, an insurance provider is pleased to lower their rates.

Examples of these insurance coverage programs consist of: Metromile (offered in 8 states) Allstate's Milewise (offered in 12 states and Washington, D.C.) Nationwide's SmartMiles (readily available in Illinois) Esurance's Pay Per Mile (offered in Oregon) It's likewise handy to make use of rate contrast tools online. When you compare rates from various business, you can be sure that you're getting the most affordable possible rate for the coverage you need.

com, which enables you to examine numerous plans used in your area. This site consists of both smaller sized, regional brands and major brand names to assist you perform an extensive and comprehensive search. Some insurer likewise use telematic gadgets, which are set up in automobiles to keep track of driving practices. The device can detect whether you brake hard, swerve often, or take part in any other driving habits that could https://sergiovunu210.page.tl/An-Unbiased-View-of-What-Does-An-Insurance-Underwriter-Do.htm increase your threat of an accident.

Where you live also impacts the rate, even from the very same company. For example, motorists in Alabama pay an average of $1,287 a year for a policy through Allstate, which is the state's lowest rate for those who do not have connections to the U.S. armed force. In the same state, the average rate for a policy through Geico is $487 higher.

In California, Esurance offers the least expensive policy at $1,196, typically, but New York chauffeurs pay approximately $3,544 per year for the same policy. Sources: This content is produced and kept by a 3rd party, and imported onto this page to assist users offer their More helpful hints e-mail addresses. You may have the ability to discover more info about this and comparable content at piano.

The smart Trick of I Need Surgery And Have No Insurance Where Can I Get Help That Nobody is Talking About

When you hear the word "cheap," you may consider bad quality, however low-cost also indicates inexpensive, as in economical vehicle insurance. And there are a lot of avenues you can require to get quality automobile coverage at a budget-friendly cost. Getting low-cost vehicle insurance can be as easy as driving responsibly or tinkering with your policy to discover a balance between expenses and protections.

Your driving history is perhaps one of the most substantial aspects in identifying your insurance cost. Fortunately, accidents and moving infractions typically get stricken from your automobile record after a couple of years, so your cars and truck insurance ends up being more economical. For circumstances, moving violations and at-fault accidents usually affect your driving record for three to 5 years (although this might differ by state and insurance provider for at-fault mishaps).

If your record is devoid of tickets or accidents, you might be rewarded with additional savings on your Progressive Car policy. Intrigued in discovering more? See how car insurance coverage works. Another method to get affordable cars and truck insurance is to personalize your quote by picking only the coverages and limits you require.

If you do this, your lorry won't be safeguarded versus orlando timeshare deal damage, but if your automobile is settled and worth less than a few thousand dollars, this coverage might not make good sense to keep. Consider getting a quote with Progressive's Call Your Cost tool, which shows you the best protection alternatives for your spending plan.

If you wish to decrease the cost of your automobile insurance coverage and want to pay more out of pocket in case of an accident, your vehicle insurance provider will normally let you increase your deductible. With a Progressive Vehicle policy, you can increase your deductible at any time during the life of your policy.

The 20-Second Trick For How Much Is The Penalty For Not Having Health Insurance

The change in premium based upon changes in deductible amounts show Progressive's direct automobile Ohio rate filing as of August 2019. View this table as an image. Some insurance providers, like Progressive, use discount rates for bundling your vehicle insurance coverage with other policies. Do you have house, tenants, bike, RV, or boat insurance with Progressive? If so, you're eligible for the Multi Policy Discount Rate on your Progressive Automobile policy.

Simply sign your files online to make this discount rate. If you have two or more vehicles on the very same policy, you'll get a lower price on your car insurance coverage. Make another discount rate when you pay for your six-month policy upfront. Prefer to pay for your policy as you go? Register for automated payments and get a discount rate.

Want more methods to get low-cost automobile insurance coverage through discount rates? Learn more about bundling insurance coverage and other discounts you may get approved for. Keeping your policy's motorist and car information current might save you money. Is there a relative who no longer drives your lorries, or do you have a lorry you don't drive any longer? If so, remove them from your policy immediately.

A surefire method to discover low-priced automobile insurance coverage is to compare competitor pricing. Progressive conserves you the legwork with our practical rate comparison tool. GOODDRIVERGOODDRIVERGOODDRIVERGOODDRIVER Photo is a complimentary program that personalizes your rate based on your real driving. The safer you drive, the more you conserve (how to become an insurance adjuster). The typical chauffeur saves $145 with Picture. * You do not even require to be a Progressive client to attempt it simply register for the Photo Road Test.

Speak to a certified agent who will assist you through every step of the process. Need local suggestions? We'll link you with a licensed independent representative near you. Related posts The above is implied as basic details to help you understand the various elements of insurance coverage - how to fight insurance company totaled car. This information is not an insurance policy, does not refer to any specific insurance coverage, and does not customize any provisions, constraints, or exclusions specifically stated in any insurance coverage policy.

Getting The What Is A Premium In Insurance To Work

Protections and other features differ in between insurance companies, differ by state, and are not available in all states. Whether a mishap or other loss is covered is subject to the terms of the real insurance plan or policies associated with the claim. References to average or common premiums, quantities of losses, deductibles, costs of coverages/repair, etc., are illustrative and might not use to your circumstance.

Everyone wishes to conserve cash without passing up quality. Some insurance provider focus on the bare necessities for you to drive legally bodily injury and property damage liability with the minimum limitsalong with a claims process that's spotty at finest. Instead of gamble on that inexpensive car insurer, you can get quality protection that won't spend a lot with Nationwide.

We offer versatile protection and billing choices, allowing members to pay monthly, quarterly or semi-annually online, through the mail or over the phone. It is necessary to keep long-term flexibility in mind when deciding on an insurance carrier, and to not simply opt for the least expensive cars and truck insurance coverage option readily available. You can get more inexpensive cars and truck insurance rates on Nationwide coverage with our car insurance coverage discounts, such as: Multiple policies discount When you bring numerous kinds of insurance coverage from Nationwide (car insurance coverage, house insurance, life insurance coverage, bike insurance and so on), you could get approved for lower premiums on each policy than if you had different policies from different insurers.

The Ultimate Guide To How Much Will My Insurance Go Up After An Accident

Medicaidthe joint state and federal healthcare programwill cover the expense of long-term care in your home and in experienced nursing facilities. It presently is the main payer in the nation for long-lasting care services. However, you should have restricted income and possessions to get approved for Medicaid. Earnings requirements vary by state, however, normally, your assets (omitting your house and one cars and truck) can't surpass $2,000 as an individual or $3,000 as a couple.

Numerous people plan to depend on Medicare or Medicaid to pay for long-term care, according to a 2018 study by Lincoln Financial Group and Versta Research Study. Long-term care insurance can be utilized to spend for help when the insurance policy holder can't perform two of the six activities of daily living or has cognitive disability, says Tim Dona, president of Newman Long Term Care, an independent insurance coverage brokerage company in Minnesota.

The majority of long-lasting care policies also will cover adjustments to your house to make it simpler to remain there to get care, Dona says. The amount of coverage a policy will provide will depend upon the advantage duration and benefit amount you select. The average benefit period insurance policy holders select is three years, Dona states.

The optimum benefit is then based on the month-to-month benefit quantity and advantage duration. timeshare value For instance, a long-term care policy with a $5,000 regular monthly benefit and a three-year benefit duration would have an optimum benefit of $180,000. Depending upon how long you require care and how much it costs, long-lasting care insurance coverage can assist cover some and even all of the cost of care.

How To Get A Breast Pump Through Insurance Fundamentals Explained

" If you don't require long-lasting care, you're entrusted to that feeling that all of those premiums were for nothing," Dona says. Life insurance policies that include a long-lasting care advantage ease the concern about spending for protection you might never use. They can be used to spend for long-lasting care expenditures and will pay a death benefit when the guaranteed person dies.

The 2020 Insurance Barometer study carried out by Life Happens and LIMRA discovered that the top reasons people purchase mix life products is to be affordable with their resources, to relieve anxiety over long-term care expenses, and to prevent the cost of two policies, says Jon Voegele, chairman of Life Happens, a not-for-profit insurance education resource.

That's since the quantity of long-lasting care coverage you get will depend on the kind of protection you purchase. And your death benefit will be affected if you tap the policy to spend for long-term care. Life insurance policies that consist of long-lasting care advantages are irreversible life insurance coverage policies, not term life policies.

This is a real hybrid policy that connects a life insurance coverage policy with a long-lasting care policy. Generally, the long-term care advantage quantity amounts to about 5 times the premium you pay, Dona states. For instance, a healthy 55-year-old man who made a $100,000 swelling amount premium payment might get long-lasting care https://diigo.com/0jw6tm benefits worth nearly $523,000.

The 30-Second Trick For How To Get Cheaper Car Insurance

According to the American Association for Long-Term Care Insurance Coverage, 84% of long-lasting care security bought in 2018 was linked-benefit coverage. Just 16% was stand-alone long-term care insurance. This feature permits you to include on long-lasting protection to a life insurance coverage policy at the time you purchase the life insurance coverage policy (it can't be included later).

" This technique might be helpful for someone where life insurance is more of a concern than long-lasting care insurance coverage, as the long-term care is sometimes a 'by the method,'" he says. Both of these items will pay through repayment of the real expense of care or an indemnity design that pays a particular cash advantage despite the real expense of care.

However, most of these policies still offer a death benefit of $15,000 to $20,000 if you utilize all of the protection for long-term care, Dona states. This function on a life insurance policy would enable you to accelerate the death benefit to spend for care if you have a chronic illness that will last for the rest of your life.

These riders utilize the indemnity villa roma timeshare design for payments. In addition to paying a survivor benefit if long-term care isn't needed, hybrid products have other functions that make them more appealing than standard long-term care insurance coverage. The premium is guaranteed on hybrid items and will not increase over time, Voegele says. This attract customers because premium increases (often extremely high) prevailed with standard long-term care insurance plan in the past.

Excitement About How Many People Don't Have Health Insurance

Hybrid items offer versatile exceptional payment choices. You can make one lump-sum payment or pay premiums over time, Dona says. Traditional long-lasting care policies typically do not use a single premium payment option. It can be simpler to qualify for protection because the underwriting can be less strict with a hybrid policy than a traditional long-term care policy, Voegele says.

If it utilizes an indemnity design that pays money rather than reimbursement for the real expense of care, you might use that money to pay a family caretaker. This isn't an option with standard long-term care policies, which pay claims by compensation just. Long-term life insurance policies build cash value, which you can tap to cover costs other than long-lasting care.

The biggest con of a hybrid item is that you're not getting the best protection for your cash, Dona says. "You do not need to pay the insurer to bundle them for you," he says. If your top concern is long-term care, you'll get more protection for your cash with a stand-alone long-term care policy.

For example, a couple age 55 would pay $5,532 yearly for a linked-benefit policy with a $150,000 death advantage and $330,000 long-lasting care advantage, Dona says. Nevertheless, they would pay $4,000 each year for a stand-alone long-term care policy with a $330,000 benefit (how to fight insurance company totaled car). Other disadvantages to hybrid policies consist of the following: Hybrid policies have actually restricted ability to be tailored for private requirements, Voegele says.

Getting The How Much Does An Mri Cost Without Insurance To Work

Standard plans can have elimination periods that vary from thirty days to two years, he says. A longer period can lower the premium. Con: Long-term care payments can significantly lower money worth or the death benefit of a hybrid policy. If you purchased the policy since you have liked ones who will need the death advantage, that benefit may not be there when they need it.

This option increases the cost of a policy, but it permits the worth of the policy to increase with the increasing cost of long-lasting care. The tax advantages of hybrid policies might not be as generous. Both hybrid and standard long-lasting care insurance coverage payouts are tax-free. However, if you're self-employed, you can subtract the expense of long-lasting care insurance coverage premiums.

Conventional long-term care policies typically are qualified to be part of state Medicaid partnership programs. With a collaboration policy, you do not have to spend down all of your properties to receive Medicaid. Hybrid policies are not eligible for these partnership programs, Roers says. Lincoln Financial Group and OneAmerica are the top two providers of hybrid life insurance coverage policies, Dona says.

Facts About What Is Full Coverage Car Insurance Uncovered

Make a note of your inventory in a spreadsheet and keep it in a safe location, such as a safe deposit box at a bank or post workplace. Consider utilizing an online home inventory tool. Things 2018 timeshare calendar to consider: Consider guaranteeing your belongings for "replacement cost," which would cover the cost of changing your TV, instead of "actual money worth" that only covers Continue reading how much your utilized TELEVISION is worth today. how much does long term care insurance cost.

Check these limitations in your policy and think about buying extra protection to guarantee such items. If you run a service in the house or have a home-based workplace, your homeowners insurance will likely limit protection for any work-related products. You might desire to think about adding extra protection to your existing property owners policy, if your insurer offers this alternative, or purchasing a different small company insurance plan.

Things to think about: If you lease part of your home, your house owners insurance coverage can reimburse you for the loss of income. If you run a business at home or have a home-based workplace, you won't be able to claim any loss of income related to your organization if something occurred to your house (what is a certificate of insurance).

This part of your house owners insurance plan secures you against potential suits that might arise from accidents. It likewise can safeguard you from damages that you, your family, or your animals might cause to other individuals. It will cover expenses such as your personal defense in a suit, medical expenses for others, and the damages you may be accountable forup to the limits of your policy.

Nevertheless liability lawsuits expenses can easily surpass these amounts. For this reason, consider an umbrella policy that provides greater amounts of liability protection. Aspects such as the breed of your pet dog or including a swimming pool or trampoline may affect your eligibility and/or the expense of your homeowners insurance coverage. Think about including extra liability protection through an umbrella insurance plan to safeguard your personal possessions and your future earnings.

We're committed to aiding with your financial success. Here you'll find a large range of practical information, interactive tools, useful techniques, and more all developed to help you increase your financial literacy and reach your financial objectives.

The 7-Second Trick For How To Check If Your Health Insurance Is Active Online

You know you require property owners insurance coverage to safeguard http://israelkdub666.iamarrows.com/some-known-details-about-why-is-my-insurance-so-high your house but countless choices can appear overwhelming. In addition to finding out what kind of house owners protection you'll need, it's also important to find out just how much home insurance coverage you'll require to properly protect your property. It is essential to set reasonable policy limitations based on your specific house, home and belongings.

Insurance is created to assist you prepare for the worst. In the unfortunate occasion that your home needs to be entirely reconstructed due to a covered accident, a home insurance coverage would preferably cover the whole cost (minus your deductible). Rather than merely insuring your house for how much you paid for it, you ought to consider the expense of rebuilding, market fluctuations in your area and your house's age when approximating the restore expense.

You can even deal with a specialist to get a more precise figure. Among the most important functions of house insurance coverage is that it can protect your valuables in the occasion of a fire, wind damage or other covered mishaps. To make sure that your policy limitations can cover whatever in your home, take a stock of all of your home's contents, room by space.

In case you and your family are unable to live in your house in the after-effects of a covered mishap, just how much would it cost you to reside in a hotel or other short-lived housing? Beyond the per-night expense, there are other everyday expenses that you would incur if you were momentarily displaced, such as increased transportation costs, food costs and more.

House insurance coverage does more than safeguard your house and your belongings. The best policy can likewise protect you from paying out of pocket if you are discovered responsible for a guest's physical injuries. If the expenses associated with their injuries exceed your policy limit, they could take legal action versus you.

Choosing just how much property owners coverage you'll require is a huge decision. Once you have a price quote, you can begin your property owners insurance coverage quote from Nationwide. Our policies are personalized to your special needs.

How Many People Don't Have Health Insurance for Beginners

Opportunities are, your house is your most valuable property. To protect it, you need to have a thorough house owners insurance coverage. However purchasing house owners insurance surpasses paying repair work and replacement costs it likewise safeguards your cost savings and investments. Although local and state federal governments do not require you to bring house owners insurance, home mortgage lenders normally do.

But mortgage companies only consider the amount of insurance coverage required to cover their financial investment. On the other hand, your household and belongings hold a much higher value than the physical structure of your house. That's why having enough insurance coverage throughout the board is important. However if it's your very first time purchasing homeowners insurance, the procedure can appear daunting.

Fortunately, finding the protection you require is as easy as following a couple of simple standards. The term "property owners policy" usually refers to a set of policies that cover your home, its contents and other associated structures. You should figure out the various policies you require, along with the coverage limitations and deductibles required for each kind of protection.

It covers your home and connected structures, like a garage or carport. Other structures policies cover unattached structures on your home such as a detached garage, shed or fences. A personal effects policy covers the contents of your house, such as furnishings and clothing. An additional living expenses policy can cover some or all your living costs when displaced from your house following a certifying catastrophe.

Individual liability policies help pay claims when somebody sustains an injury in your home or on your property. For circumstances, if a kid falls from a tree in your lawn, your personal liability policy might help pay an award or legal fees following a suit. If someone who does not reside in your home sustains an injury in your home or on your home, your medical payments coverage can help pay medical expenses.

Flood insurance spends for damages and losses triggered by floods. A lot of house owners policies do not include flood coverage and numerous insurance business do not provide flood insurance coverage. Numerous house owners purchase flood insurance through the National Flood Insurance Coverage Program, administered by the Federal Emergency Management Company. A lot of house owners policies do not cover damages or losses brought on by earthquakes. how do i know if i have gap insurance.

7 Simple Techniques For How To File An Insurance Claim

Umbrella policies help pay liability claims after your individual liability insurance coverage reaches its limitation. For example, if a court awards a hurt person $500,000 after sustaining an injury on your home and your personal liability policy has a $200,000 limitation, your umbrella policy could pay the difference. Prior to you acquire a house owners insurance coverage policy, you need to identify just how much protection you require.

Not known Factual Statements About How Do Health Insurance Deductibles Work

Nationwide uses the following aspects of your insurance coverage credit rating when figuring out premiums: Your payment history, consisting of late payments and failure to payThe length of your credit historyThe types of credit in your history Some insurer charge you a fee every time you make a payment or they mail you a bill (how many americans don't have health insurance).

For orlando timeshare promotions with universal tickets example, Farmers Insurance coverage charges you up to $2 if you do not get bills via e-mail. And if you don't have your payment automatically subtracted from your bank account, this insurance provider might charge you approximately $5. If you are late with a payment, you run the danger of having your protection dropped and of getting struck with a charge.

Laws relating to the fees insurance providers can charge you vary by state. If you are not driving among your cars and plan to keep it in storage for more than a month, you may cancel or temporarily suspend insurance for itthough some companies allow you only to do the previous.

And if you're still paying on the cars and truck, your loan provider may need you to preserve insurance coverage under the terms of your loan agreement. A much better concept may be to suspend your liability and accident protection but retain your extensive coverage in case the automobile gets taken or harmed. what is a health insurance deductible.

Sadly, the quote you were trying to gain access to is ended or no longer available. We 'd enjoy to assist you start a new quote listed below. A quote from The General is totally free and there is no dedication. You can conserve your quote at any point during the process and return to it at your leisure. As you can see from our list, there are many ways to get cheap vehicle insurance. By doing your research study and discovering the ideal strategy for you, you can find a vehicle insurance coverage at the right cost.

The Best Strategy To Use For How Much Do Prescription Drugs Cost Without Insurance?

Did you know the precise very same driver could be charged $36 per month by one insurer and $123 each month by another? Our cars and truck insurance analysis based on hundreds of countless quotes gathered throughout the country backs that up. Read on to discover the most affordable business in the nation, in your state and for particular kinds of motorists.

No single insurer will be the most inexpensive for every motorist, but our research will give you a good foundation to start your search. Our analysis discovered that and are the most economical major insurance companies in the nation. USAA cost approximately $215 for a six-month policy, 55% listed below the nationwide average.

Although is quickly the most inexpensive choice amongst major insurance providers, only active military members, veterans or their families will receive a policy. Amongst insurance companies that have a smaller sized national footprint,, at $218 for a six-month policy, and, at $226, rank as the least expensive. These insurance companies don't have the same name acknowledgment as some of the companies you might acknowledge from nationwide tv projects, but might help you discover cost savings if you're trying to find the least expensive rate.

After you've found your dream automobile, it's time for a less-exciting job: finding the ideal vehicle insurance plan. This process can be inconvenient and costly, but in order to safeguard your financial investment and follow the guidelines of the roadway, it's a need. Luckily, discovering inexpensive cars and truck insurance coverage quotes is simple.

If you don't desire to invest your entire day dealing with car insurer, have the following info on hand to get a precise online auto insurance coverage quote today!: Required info consists of date of birth, address, occupation, and marital status.: If you're getting an automobile insurance coverage quote for a new car, reach out to the personal seller or car dealership to get the VIN.

Some Of What Is A Deductible Health Insurance

Have on hand a brief history of your automobile insurance coverage background. An automobile insurance coverage quote is a price quote of what you can expect to spend for insurance coverage from a specific business. Car insurance quotes are figured out by the individual information you provide. Aspects such as credit history, driving history, and age contribute to car insurance coverage rates.

Lots of companies advertise complimentary car insurance quotes. Any automobile insurance quote you receive is and must be completely totally free. Insurer wish to incentivize you to acquire a cars and truck insurance plan from them, so they won't charge you for an in advance evaluation (the quote). When comparing insurance coverage rates, remember: you can find inexpensive online car insurance prices quote totally free from a range of sources.

Automobile insurance business examine your whole driving profile to estimate this risk, including aspects such as location, demographics, insurance history, driving record and car. Since most kinds of insurance are managed at the state level, state legislation influences cars and truck insurance coverage premiums. For example, in, a, the law requires an unlimited amount of coverage, a requirement that increases the cost of vehicle insurance.

Below is an analysis of the cheapest and most costly states for automobile insurance (from The Zebra's State of Insurance coverage report). Whether you can get an inexpensive cars and truck Visit this website insurance coverage quote might come down to your ZIP code. If you reside in a densely inhabited location with a high number of automobile insurance claims, your premium will be more expensive than that of a person living in an area of town in which less claims are filed.

Every business takes various qualities into factor to consider, consisting of these typical ranking factors: Unless you're a, your gender isn't a significant automobile insurance coverage ranking element. In reality, the national distinction in between car insurance premiums paid by and men is less than 1%. For teenagers, this premium distinction is much more significant: male teen motorists pay $1,000 more per year than do female teenagers.

More About What Does Enterprise Car Rental Insurance Cover

Automobile insurer' historical data states young male motorists are most likely Go here to take threats while driving than are female chauffeurs in the very same age group.$ 3,897$ 3,378$ 3,366$ 2,904$ 3,070$ 2,631$ 2,409$ 2,044Your age helps to determine your automobile insurance premium. Statistically, a is less experienced and most likely to receive a citation or file a physical injury or property damage claim.

e - how much does pet insurance cost., a greater premium. Your probability of getting low-cost auto insurance estimates increases once you turn 19, and once again at, as you become less most likely to drive recklessly. This remains consistent up until you enter into your when car policy rates begin to tick up once again. While the difference is little, drivers are most likely to get inexpensive vehicle insurance coverage quotes than,, or widowed chauffeurs.

Single$ 774Married$ 725Divorced$ 772Widowed$ 750Discover more about how your marital status impacts how much you spend for your insurance plan. On average, face higher vehicle insurance coverage premiums than do condominium owners or but not by much. The distinction is only about $17 every six months, compared to the rates a homeowner would pay. Homeowners earn cheaper cars and truck insurance rates due to the fact that they're considered more solvent and less likely to submit a claim.

The smart Trick of How To Start An Insurance Company That Nobody is Talking About

This looks great on paper given that it's expected to provide you back the expense of the policy if you survive through completion of the term (and we're hoping you do!). What about all those premiums you paid? You'll get them back. But those premiums are greater in the first location.

In the end, it's not worth it if you're paying more in the very first place. A guaranteed or "simplified" term life strategy is one you can get without a medical examination. You may just need to submit a medical questionnaire rather than get poked and prodded. Butyou guessed itthere's a catch with this one too.

That's because without the medical tests, all the insurance provider has to go on is http://lorenzoscrv985.theburnward.com/6-easy-facts-about-how-to-shop-for-car-insurance-explained your age and the truth you're searching for insurance coverage that doesn't require a medical examination. This suggests you're going to be classed (by the insurance experts) as a "higher than average risk." So you'll likewise be charged a greater than typical premium.

Which is transforming it to a permanent life insurance coverage policy down the line. We state, don't do it! It's not worth the hike in premiums you'll be paying. Some individuals might transform if they're coming towards completion of their policy and have a terminal health problem, however that's an unusual example.

The Definitive Guide to What Is A Certificate Of Insurance

Your employer may offer as an advantage to staff. They may even pay the entire premium in some cases. In either case, it's inexpensive. We'll constantly advise you take the free alternative, however compare it carefully to what you can get on your own prior to you chip in for it. Likewise check the death benefit, since a company payment could be a lot less than one you secured on your own.

Of all the types to select from, we believe a level premium term life policy is your best choice. Get protection that's 1012 times your income and a term that's 1520 years in length. You'll have a premium and survivor benefit payment that won't change. This is life insurance with no frills or bonus you don't need.

Funeral costs, childcare, education for your kids (consisting of college), and your home mortgage are the most common expenses to cover. If you're wed, will your spouse work after your death? If so, you might not require to supply as much with another earnings in the mix. We understand we sound like a broken record, but you ought to constantly get 1012 times your earnings.

That method if your household wishes to invest some or all of your survivor benefit into an excellent shared fund, they could make a good quantity on it and maintain your income even after you're gone. what is a health insurance premium. By now you understand how we feel about life insurance. It has one job: to change your income if you die.

4 Simple Techniques For What Is Group Term Life Insurance

You can do that all yourself by following the Infant Steps and investing carefully. And that's why we'll always advise term life insurance coverage over the others. Our good friends at Zander Insurance coverage know the ins and outs of the insurance coverage company. They've been helping folks discover the very best life insurance coverage policy for more than 50 years.

Lots of or all of the products featured here are from our partners who compensate us. This may affect which products we compose about and where and how the item appears on a page. However, this does not affect our examinations. Our opinions are our own. Entire life insurance can offer you long-lasting protection and offer additional assistance throughout retirement.

After you're gone, your household can utilize the profits from either kind of policy to cover funeral expenses, home loan payments, college tuition and other expenditures. While the death advantages of whole and term life can be comparable, there are key differences between these two popular types of life insurance coverage. is the easiest to understand and has the most affordable costs.

You can get life insurance prices quote online. is more complex and tends to cost more than term, but it uses fringe benefits. Whole life is the most popular and most basic form of irreversible life insurance coverage, which covers you up until you pass away. It likewise provides a cash-value account that you can tap for funds later on in life.

The Ultimate Guide To How Does Health Insurance Deductible Work

Term life insurance coverage supplies coverage for a particular time period. It's frequently called "pure life insurance coverage" since it's designed just to safeguard your dependents in case you die prematurely. If you have a term policy and die within the term, your beneficiaries receive the payment. The policy has no other worth.

Typical terms are 10, 20 and thirty years. With most policies, the payout called the survivor benefit and the expense, or premium, stay the same throughout the term. When you look for term life: Choose a term that covers the years you'll be footing the bill and want life insurance coverage in case you die.

The 15 steps on how south lake tahoe timeshare to cancel timeshare contract for free payment might change your earnings and assist your household spend for services you perform now, such as childcare - which of the following typically have the highest auto insurance premiums?. Preferably, your requirement for life insurance coverage will end around the time the term life policy ends: Your kids will be on their own, you'll have paid off your home and you'll have lots of money in savings to function as a financial safeguard.

Entire life insurance provides lifelong protection and includes an investment component referred to as the policy's money value - how much does life insurance cost. The cash value grows gradually in a tax-deferred account, implying you won't pay taxes on its gains while they're collecting. You can obtain cash against the account or give up the policy for cash.

7 Easy Facts About How Much Does A Tooth Implant Cost With Insurance Shown

Although it's more complicated than term life insurance coverage, whole life is the most straightforward kind of long-term life insurance. Here's why: The premium stays the very same for as long as you live. The death advantage is guaranteed. The money value account grows at a guaranteed rate. Some entire life policies can also earn annual dividends, which pay you back with a little the insurer's revenue.

Dividends are not ensured. Term life insurance coverage is cheap because it's short-lived and has no money value; in many cases, your family won't receive a payment since you'll live to the end of the term. Entire life insurance premiums are much greater because the protection lasts for a life time, and the policy has money worth, with a guaranteed rate of investment return on a portion of the cash that you pay.

What Is A Certificate Of Insurance Fundamentals Explained

Presume, for example, that a person has a 7. 5% repaired, 30-year mortgage on a $200,000 home with a down-payment of 10%. As seen in Table 1, considered that the property owner will stay in the home for the life of the home mortgage and thinking about the existing complete mortgage interest tax deduction, the pre-tax rate of return required on money invested outside of the home is 14.

88%. Unless liquidity is a significant williamsburg plantation timeshare concern to the homeowner, investing in house equity is the preferred method. Down-payment percentage5% 10% 15% 20% Down-payment (initial house equity)$ 10,000$ 20,000$ 30,000$ 40,000 Regular monthly home payment$ 1,329$ 1,259$ 1,189$ 1,119 Two months PMI escrow$ 247$ 156$ 91n/a Month-to-month PMI premium (years 1-20)$ 124$ 78$ 45n/a Month-to-month PMI premium (years 21-30)$ 32$ 30$ 28n/a Pre-tax rate of return required on equity beyond the home (in the home for the life of the mortgage) 14.

51% 15. 75% n/a Pre-tax rate of return needed on equity beyond the house (in the home for only seven years) 14. 24% 13. 88% 14. 92% n/a *Assumes a 28% limited federal tax rate and no state tax Return to the top of this table. Go to the spreadsheet calculations in the Appendix - Offered the low interest rates of the previous few years, numerous individuals have actually recently acquired a brand-new home or re-financed their existing house.

In order for PMI premiums to be ended, two things should take place. First, the house owner must supply evidence of the present worth of the home by obtaining an appraisal. Second, the house owner needs to reduce the loan-to-value ratio to 80% or listed below. This decrease may have taken place already as an outcome of concept being paid over the life of the home mortgage, gratitude occurring considering that the https://postheaven.net/cynhadkrnw/also-have-low-premiums-and-high-deductibles-however-they-use-better-coverage purchase of the home, or a mix of both.

The only cost required to terminate PMI would be that of an appraisal (typically in between $300-$ 600). If the appraisal showed that the home had actually valued to the point where the loan-to-value ratio fell to 80% or listed below, then the borrower would simply need to inform the lending institution of the appraisal results and demand that the PMI be terminated. To determine the appearance of this option, the expense of the appraisal is simply compared to today worth of the future PMI premiums that would be gotten rid of by showing an 80% or lower loan-to-value ratio.

The Greatest Guide To How To Become An Independent Insurance Agent

0078/12 x 200,000 x 3 = $390 = the approximate expense of an appraisal-- would this alternative not be Additional resources beneficial to the debtor. Assuming that the house owner plans to stay in the house for 6 months or longer, the rate of return earned on the financial investment in the appraisal is impressive.

In this case, the mortgagor must decide whether it is worth the financial investment in an appraisal and extra house equity in order to have actually the PMI ended. Consider, for example, an individual who assumed an 8%, 30-year set home mortgage one year ago with a 10% down-payment on a $200,000 house.

Given one year of mortgage payments, the concept owed on the home loan would have reduced by around $1,504. As seen in Table 2, the expense to terminate future PMI premiums would be the expense of an appraisal (presumed to be $400) and a financial investment in house equity of $18,496. Down-payment percentage5% 10% 15% Down-payment$ 10,000$ 20,000$ 30,000 Present loan-to-value ratio94.

25% 84. 29% Prepayment required to accomplish 80% loan-to-value ratio$ 28,413$ 18,496$ 8,580 Approximate cost of an appraisal$ 400$ 400$ 400 Pre-tax rate of return needed on equity outside of the house (in the home for 29 or more years) 11. 21% 10. 89% 11. 42% Pre-tax rate of return needed on equity outside of the house (in the house for 6 more years) 13.

31% 14. 1 Go back to the top of this table. In this example, the pre-tax rate of return on the extra financial investment in home equity is 10. 89% if the person remains in the home for the staying 29 years. In the occasion that the person remains in the home for only 7 years, the pre-tax rate of return on this financial investment is 13.

The smart Trick of What Is Short Term Health Insurance That Nobody is Discussing

Assuming that the house has actually valued, the size of the home equity financial investment needed to terminate PMI is less and results in an even greater rate of return on the financial investment in house equity (how to shop for health insurance). Among the arguments for putting money in investments aside from the house, such as stocks or shared funds, is the greater liquidity of these investments.

Must a homeowner requirement additional liquidity after putting a substantial quantity of equity into a home, there are two increasingly popular and fairly inexpensive methods to gain access to equity in the house through a house equity loan or a house equity credit line. A home equity loan is much like a second home mortgage, with the debtor getting a lump sum with a fixed rate of interest and repaired payments on the loan with terms anywhere from 5 to twenty years.

An equity line of credit is a revolving line of credit, with the borrower able to get funds as they are needed. Although equity lines are more flexible than equity loans, they usually carry interest rates that are somewhat greater than house equity loans. In addition, the rates vary and are tied to the prime rate.

In addition to the relative attractiveness of the rate of interest charged on house equity loans and credit lines, the interest paid on both of these kinds of credit is tax deductible approximately $100,000, despite what the cash is utilized to purchase. Therefore, the real rates of interest paid on these types of credit are even lower than marketed.

If closing expenses exist, for the most part a considerable part of these costs is the cost of an appraisal. In case an appraisal was just recently carried out for the functions of terminating PMI, an additional appraisal is not likely to be required. Lastly, one note of care is that, while house equity loans and credit lines are rather appealing relative to other sources of debt, they are protected by the home itself.

Getting My Who Is Eligible For Usaa Insurance To Work

The previous conversation presumes the present tax code. In the occasion that the existing argument on a change in tax law results in some substantial changes in the tax code, how might these changes impact the home equity choice? Currently, proposed changes in the minimal tax rates and the home loan interest tax reduction are the most likely to have an effect on a person's home equity investment decision.

In the occasion that legislators lower the highest minimal tax rates as a result of a flattening of the tax curve, then the mortgage interest tax deduction will end up being less valuable to homeowners who are paying taxes in the greatest tax bracket. Subsequently, the extra tax savings enjoyed by having less equity in a house (and a higher home loan interest payment) diminish, and the argument for putting more equity in a home and preventing the expenses of PMI strengthens, assuming one has the required money.

If lawmakers disallow totally the deductibility of mortgage interest, the tax advantages of a small down-payment decrease, and the rates of return needed on equity invested beyond the home boost. This, too, would enhance the argument for buying house equity for the purpose of getting rid of unnecessary PMI premiums.

4 Simple Techniques For How Much Does Urgent Care Cost Without Insurance

The specialist prescribed you some medication for your eye, so you head to the pharmacy to select it up. The prescription costs $60, so you are asked to pay $12 out of pocket (20% of $60), and your insurance looks after the staying $48. how much does flood insurance cost. While the equation may appear easy enough, it is necessary to understand the terms around coinsurance and what you're obligated to pay under timeshare rentals hawaii cancellation your insurance strategy.

A certified agent can assist you understand your coinsurance alternatives when you're prepared to shop for a brand-new plan. You likewise might have heard of copays. Copays (or copayments) and coinsurance are extremely comparable except for one secret difference: While coinsurance is a portion of the overall cost, a copay is a flat fee.

If you had a treatment that required copays rather of coinsurance under your policy, you might be asked to pay a flat charge of $20 for the doctor go to, whether the doctor billed you for $100 or $300. The journey to the expert might need a copay of $30, regardless of the services that were offered.

The benefit of a copay is that it enables greater predictability for the consumer, and they are typically more budget friendly. With a copay, you understand you will pay a set total up to see your medical professional for any reason. With coinsurance, you pay a portion of the go to, so the higher the hidden expense, the more you'll be needed to pay.

Some Known Details About What Is Comprehensive Insurance Vs Collision

Fortunately, you do not need to do it alone. Let a certified HealthMarkets representative aid at no expense to you. Coinsurance and copays are what's called "out-of-pocket" expenditures, suggesting it's something additional you have to pay when you get health care, on top of your month-to-month premium. Sometimes, your strategy may charge a copay for one type of service and coinsurance for another.

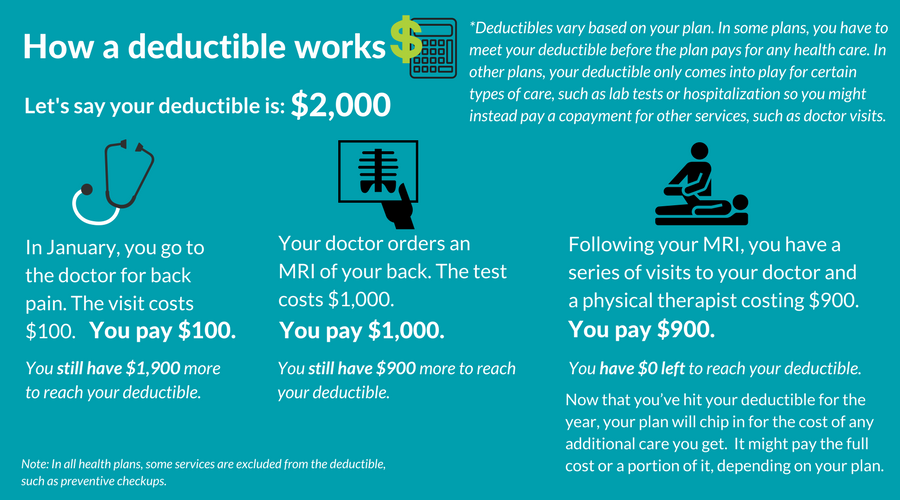

A deductible is a set amount that you need to initially pay before your insurer begins cracking in its part. For instance, if your policy features a $1,000 deductible, you would pay the first $1,000 of your healthcare expenses throughout the policy year. As soon as that number has actually been reached, your insurer would start paying its portion of the costs.

Numerous health insurance strategies will cover regular services and even prescription drugs. In truth, the Affordable Care Act requireds that preventive care, like yearly examinations, mammograms, and immunizations, not need payment towards a copay, coinsurance, or deductible. High-deductible strategies generally come with lower monthly premiums, suggesting you'll pay less monthly for your plan but will have to pay more out of pocket prior to your plan starts contributing.